A postcard on survivorship bias that influences our decisions every day.

The Story of Abraham Wald and World War II Bombers

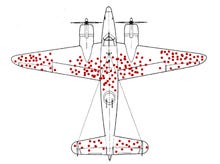

Here’s a picture of an bomber in World War II. The red dots indicate areas where the bomber was hit by enemy fire during its mission. The question:

Where would you add more armour to strengthen this bomber?

The answer:

US military’s conclusion was that the most-hit areas (red dots) of the plane needed additional armour.

However, Abraham Wald, a statistician, examined the damage to aircraft that returned from missions and recommended adding armour to areas that showed the least damage. This contradicted US military’s conclusions.

Abraham Wald had taken survivorship bias into his calculations.

Wald noted that the military only considered the aircraft that had survived their missions. Bombers that had been shot down and lost were unavailable for assessment.

The holes in the returning aircraft represented areas where a bomber could take damage and still return home safely.

Wald proposed reinforcing areas where the returning aircraft were not hit, since those were the areas (cockpit, engines) that, if hit, would cause the plane to be lost.

Survivorship Bias

Survivorship bias is the error of focusing only on things that made it past some selection process and overlooking those that did not, usually because of lack of data or visibility.

This can lead to incorrect decisions.

Find Out What You Don’t See

When making decisions, don’t look only at what you can see.

Find out the entire set of things that followed the same path but didn’t make it.

Investing and Finance

- Unsuccessful investments or funds are excluded from performance reports because they were sold or merged and so no longer exist. Only the successful surviving funds are used for sales pitches.

- Another example is the use of a current index membership rather than using the actual constituent changes over time to report performance of investing in the index.

[Note: I am not trying to discourage investing in Index fund that give you market returns. Earning market returns is a pretty good result for small investors without finance skills and often for investors with finance skills too!]

Steve Jobs, Bill Gates, and Mark Zuckerberg dropped out of college.

- If I drop out I will also become a billionaire. Where are the stories other college dropouts who later couldn’t find jobs because they didn’t finish college. In the US, like elsewhere, 90 percent plus of successful business people have college degrees.

- Reading biographies of successful people only shows that some people through their ability but mostly by chance ended up where they are. Where are the biographies of the vast majority of those who had average success and leading a normal life? We need more biographies to learn from failures.

Focusing on exceptions.

- Often businesses focus energy on unhappy customers, instead of finding what makes happy customers happy and investing precious resources so continue keeping them happy.

- News is a business built on exceptions. The things that account for less than one percent of everything that happens. The scandals and accidents but not the mundane day to day life of normal, happy people.

Beware of History

History is an highlights reel.

History is not a blow by blow accounts of everything that happened but only the highlights chosen by those who survived and won.

Ted Talk: How Survivorship Bias Skews Our Perception

The talk covers the World War II bomber example in more detail.

(Duration: 17 minutes)

Read More Like This

- The Art of Decision Making #1 – Judgement

- Lindy Effect: When Old is Gold

- Via Negativa – When Less is More

Recent Articles